| Sector: | Real estate |

| Type: | Project development |

| Level: | National |

| Partner: | Independent project led by STR/O/Y adressed at international circle of investors |

| Task: | Concept and business plan for a large-scale urban development and real estate project |

The Austrian public special purpose vehicle SIVBEG (designed for the utilization of strategic state owned real estate) announced on a short notice a public auction for the sale of the Martinek casern. The reason behind the auction was the privatization of public land belonging to the Austrian armed Forces. The object in question was a built-up plot area with slightly over 400.000m². The opportunity got the attention of large international investors and developers.

Vienna overvalued, Austria fairly priced: According to data of the Austrian National Bank (OENB), residential housing prices in Vienna have become overvalued in 2014 and a slight correction in Q3 2014 could be observed. The price indicator suggested that the rest of Austria is fairly priced and the actual price for residential real estate matched the fundamental price.

Monument protection: The Martinek casern is under monument protection and structural changes need a permission of the authorities. Buildings under protection were built in 1940 and include officers’ mess, squad buildings, plants and garages.

Lease agreements: The object includes two living quarters of the military administration and the buyer of the Martinek casern is committed to conclude an open-ended tenancy agreement with the seller.

Incremental costs: In 2011, the site has been tested on contamination and the ground bears traces of fuel components which make it necessary to bulldoze away 1-2m of the surface. However, the site has a slope of about 3m from the eastern to the western end and a straightening could be achieved in the same working process.

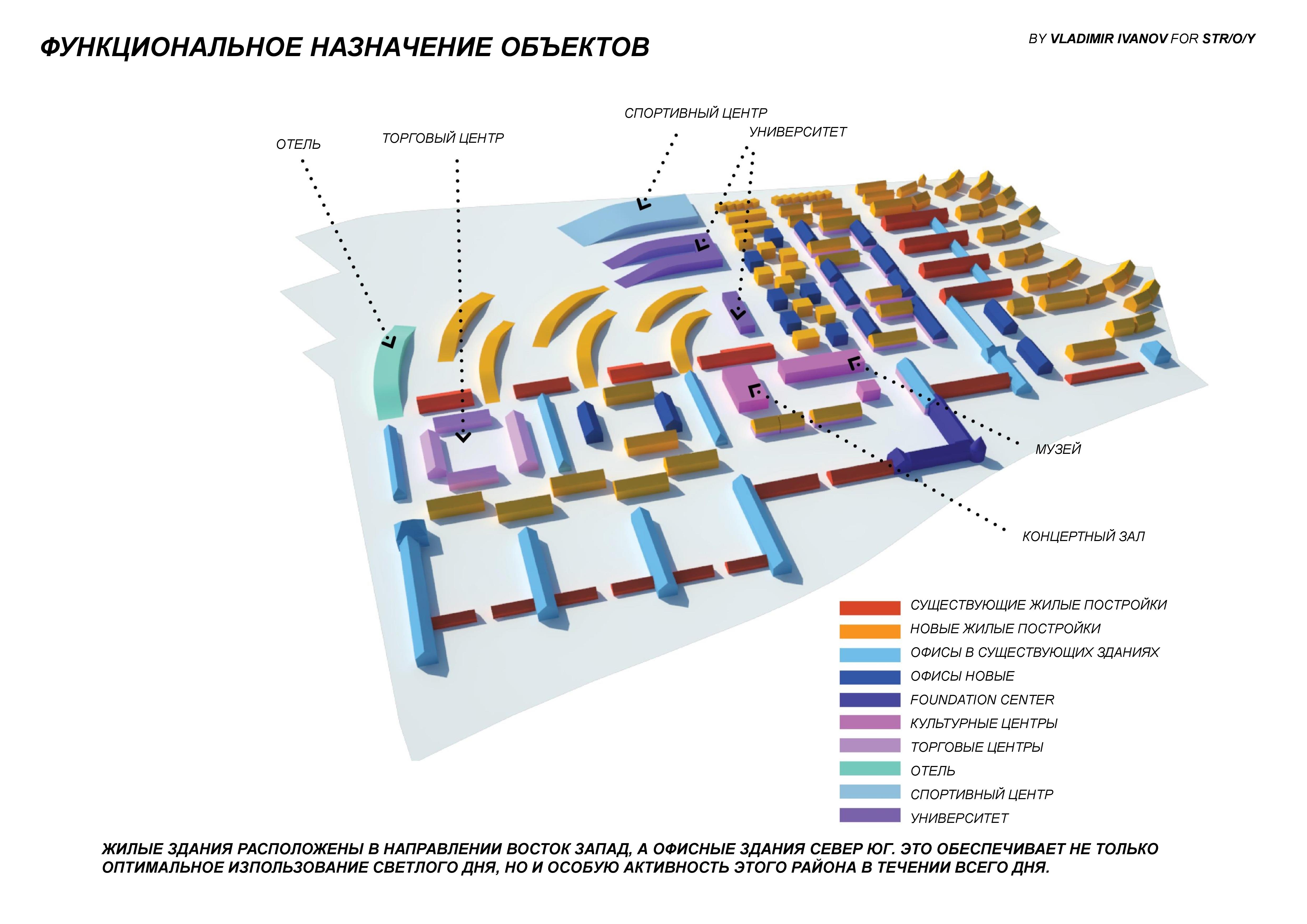

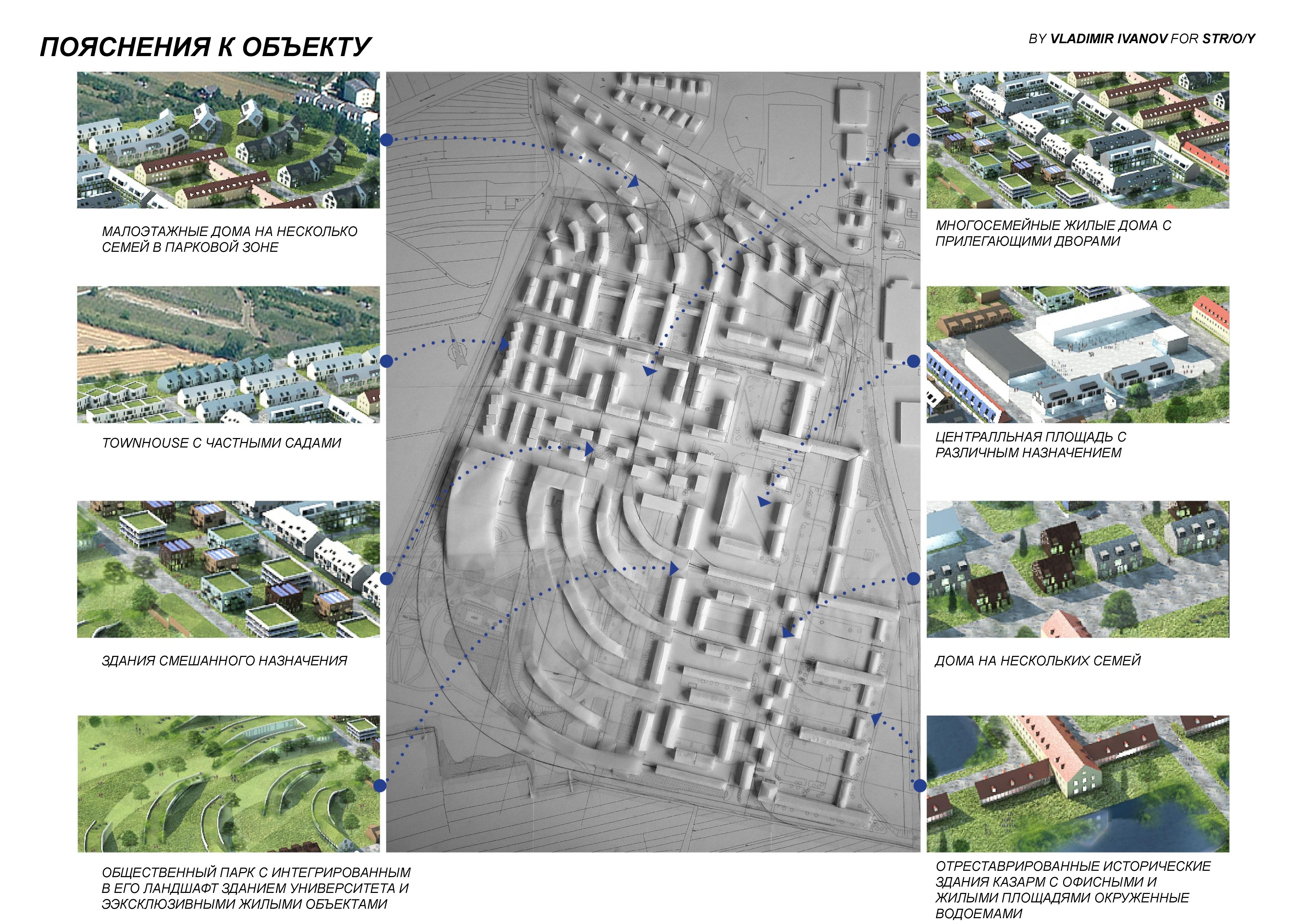

The intention is to build a bridge between regional landscape planning, urban design and heritage conservation. The regional landscape design is reflected in the management of land and water and the creation and protection of habitats tries to keep the natural environment of Baden. At the same time, the architect has dealt with the creation of a new urban design for this part of Baden and developed new open public spaces and streetscapes. Heritage conservation has a wide public awareness in Austria and was a key issue in the planning process. The intention to restore persisting building of historical importance is fully achieved and brings the buildings up to a new usage.

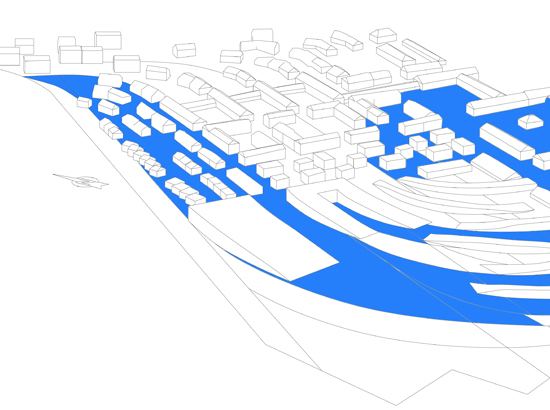

The project BADEN SÜD as envisioned by Vladimir Ivanov for STR/O/Y is serving the needs and demands of all stakeholders involved. Investors find an optimum use of the available space. In fact the maximum allowed density is achieved, while keeping almost the entire existing historic substance preserved which eases meeting all requirements. Future residents are offered a great selection of living and working space that suits all potential needs and possibilities. City and state authorities’ expectations are met and in some instances surpassed by the proposed model for BADEN SÜD. The vision integrates the new smart city perfectly into the landscape and the surrounding city structures. It offers optimum traffic access, contemporary shared space solutions, uses renewable energy sources and is itself a potential new architectural landmark for Western Europe. The design is partly inspired by the architectural treasury of the city of Amsterdam whose canal district was added to the UNESCO World Heritage List in 2010. The historical structures of Martinek casern, that outlived their intended use, are now surrounded by gardens, lakes and repurposed with excellent results.

All project requirements from the public sell side and the very tight deadlines were met. Presentations to the respective investment committees were performed.

| Sector: | Real Estate |

| Type: | Asset marketing & tender management |

| Level: | National |

| Partner: | Austrian public business agency |

| Task: | Asset marketing for a large-scale real estate project |

An Austrian public business agency invited tenders for the marketing concept of a ca. 7000 qm sized innovative real estate project, targeting technology companies, start ups and coworking users. The building is embedded in a large urban development area in Vienna. The agency needed a strategy for the right positioning, pricing, marketing and media plan.

The New Economy market in Vienna was evaluated, with a special focus being put on business models for start up offices and coworking spaces. The location and building for the project were benchmarked against existing and scheduled competition. After the object analysis was performed, success factors and pricing level recommendations were deducted. A marketing and media plan was composed making use of a tight network within the local start up business community.

This type of real estate project aimed at New Economy clients was very innovative for Vienna. In spite of scarce benchmarks the project team managed to present in-depth case studies of 7 comparable concepts. Due to the specific demands and dynamic nature of this real estate project’s target audience a very up-to-date first-hand study of the local start up community’s status and outlooks was conducted.

Despite strong competition the team created and presented the most plausible concept. The knowledgeable and creative approach outperformed the conventional marketing strategies of the other concepts, because it succeeded in answering the needs of the very specific target group – being technology companies, start ups and coworking users.

| Sector: | Real estate |

| Type: | Growth strategy study |

| Level: | national |

| Partner: | Leading Austrian real estate developer |

| Task: | Finding growth opportunities in a saturated real estate market for a large project developer |

A large Austrian private real estate development & investment company encountered difficulties with the utilisation of its top inner city assets. The time spans between acquisition and successful realisation of the investment objects was growing longer and domestic investors' demand has slowed down as well. The company needed a concept to generate additional income while holding the buildings and attract non-European investors' interest for the assets.

A rough portfolio analysis was performed and the management interviewed. Based on the informations of this first step success models of local and international competition were evaluated and compared to the features of suitable assets. After field studies in the respective buildings, innovative contemporary approaches of use were made subject to the concept proposal. Large areas around the most critical and underperforming assets were evaluated concerning their potential for the newly envisioned repurpose programmes.

In alignment with the general cooling down of the Austrian real estate market, the dynamic of the company's transactions went down. The unused assets started "piling up". Tailored to the character and loation of these assets a wide range of temporary and permanent use concepts was developed.

Concepts consisted of tailored adaptations of the existing compounds in the company's portfolio to New Economy clients, the health sector and foreign end-buyers with ability and willingness to spend in the luxury sector. In addition a rebranding strategy for better appeal to foreign investors was proposed.

After a deep analysis of the company’s current projects and the market's potentials and limitations, a study was conducted and presented to the company owner and his management. The proposals were met with great interest. However as there are currently no free capacities within the company to implement the measures, the realisation of the strategy is still to be done.

| Sector: | Retail & FMCG |

| Type: | Operations optimization / analysis |

| Level: | national |

| Partner: | Leading European food FMCG producer |

| Task: | Finding measures for sales growth in the Austrian market |

A leading European FMCG food producer encountered difficulties with the growth and operating efficiency of its Austrian branch.

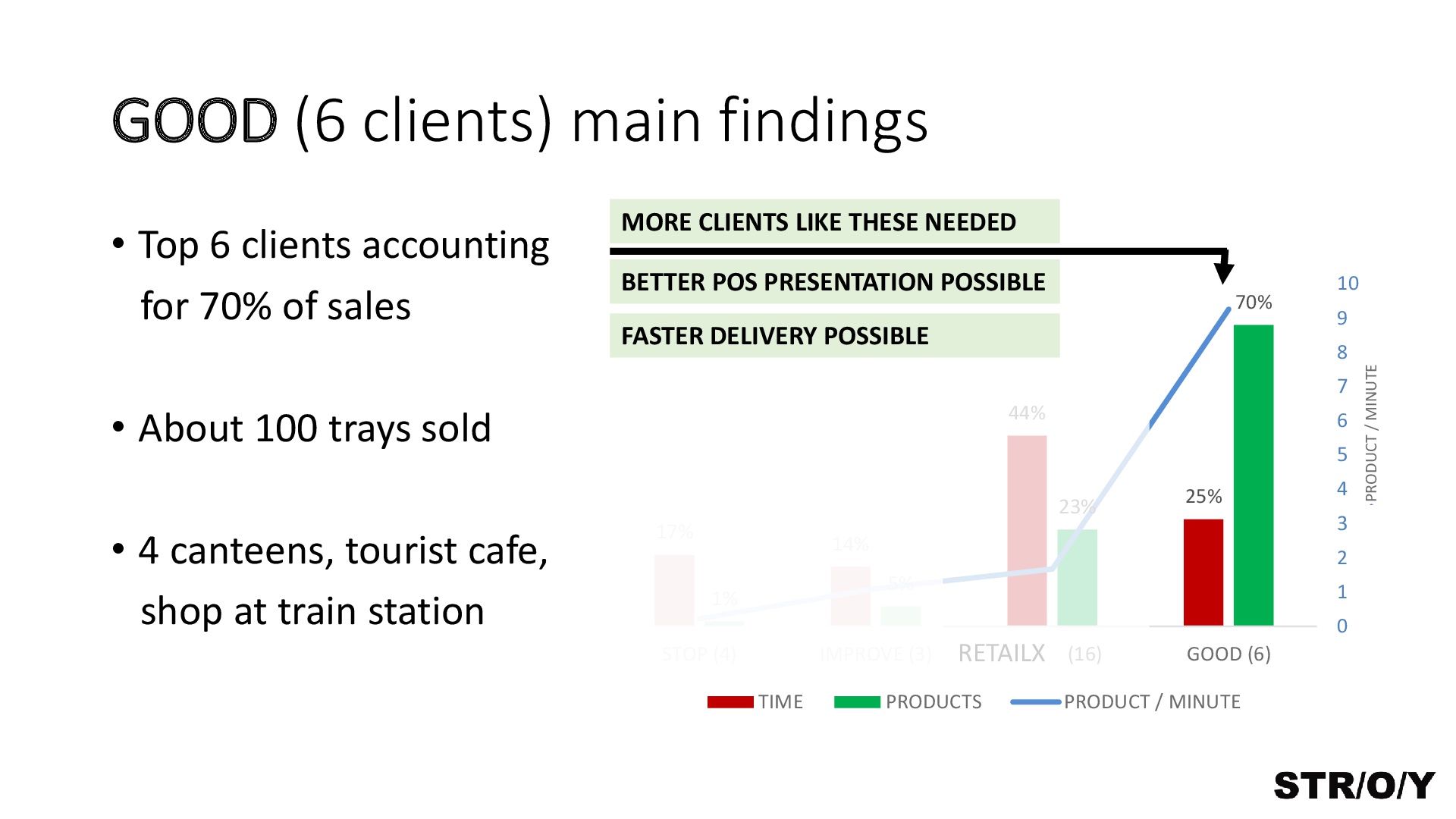

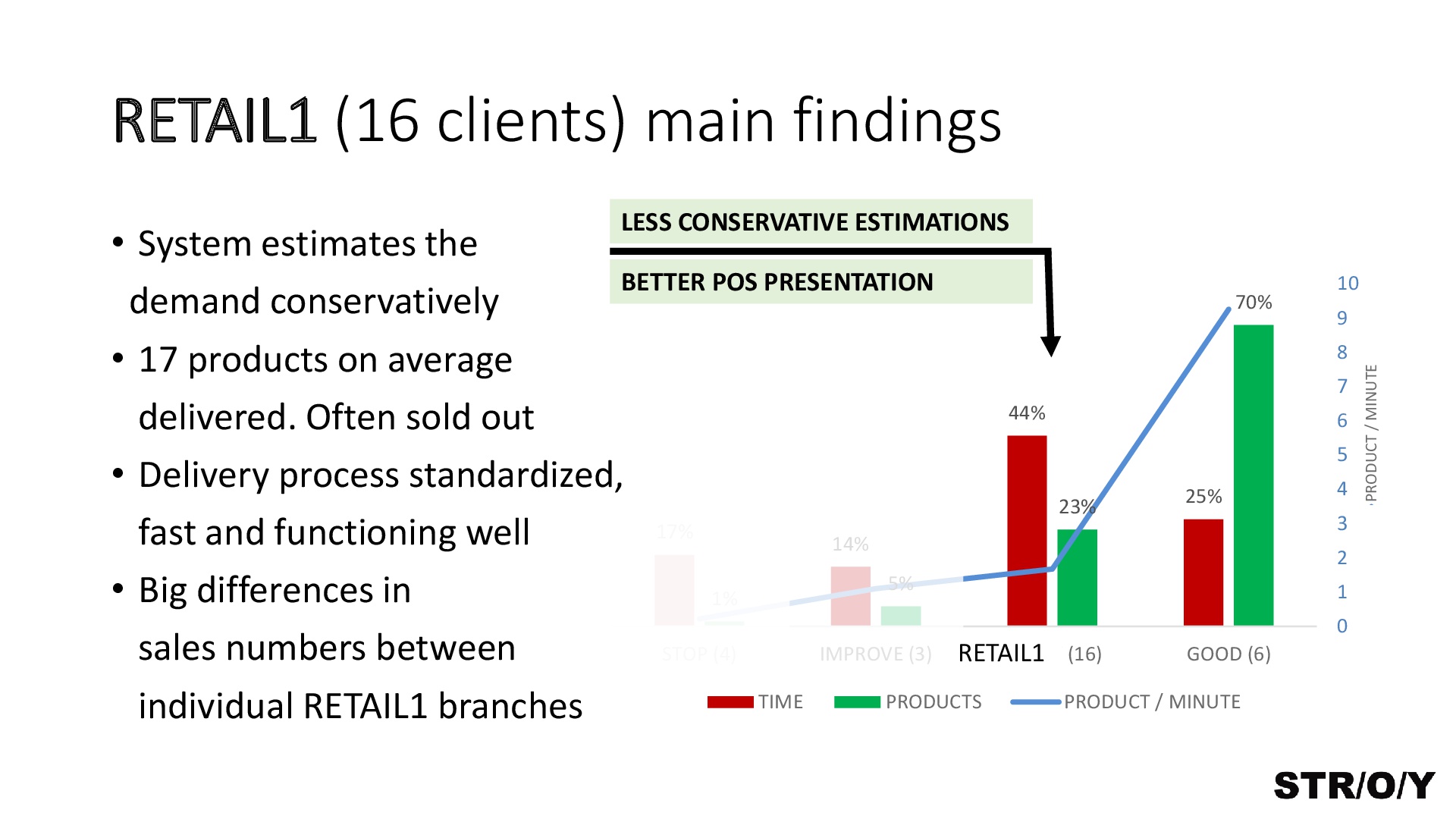

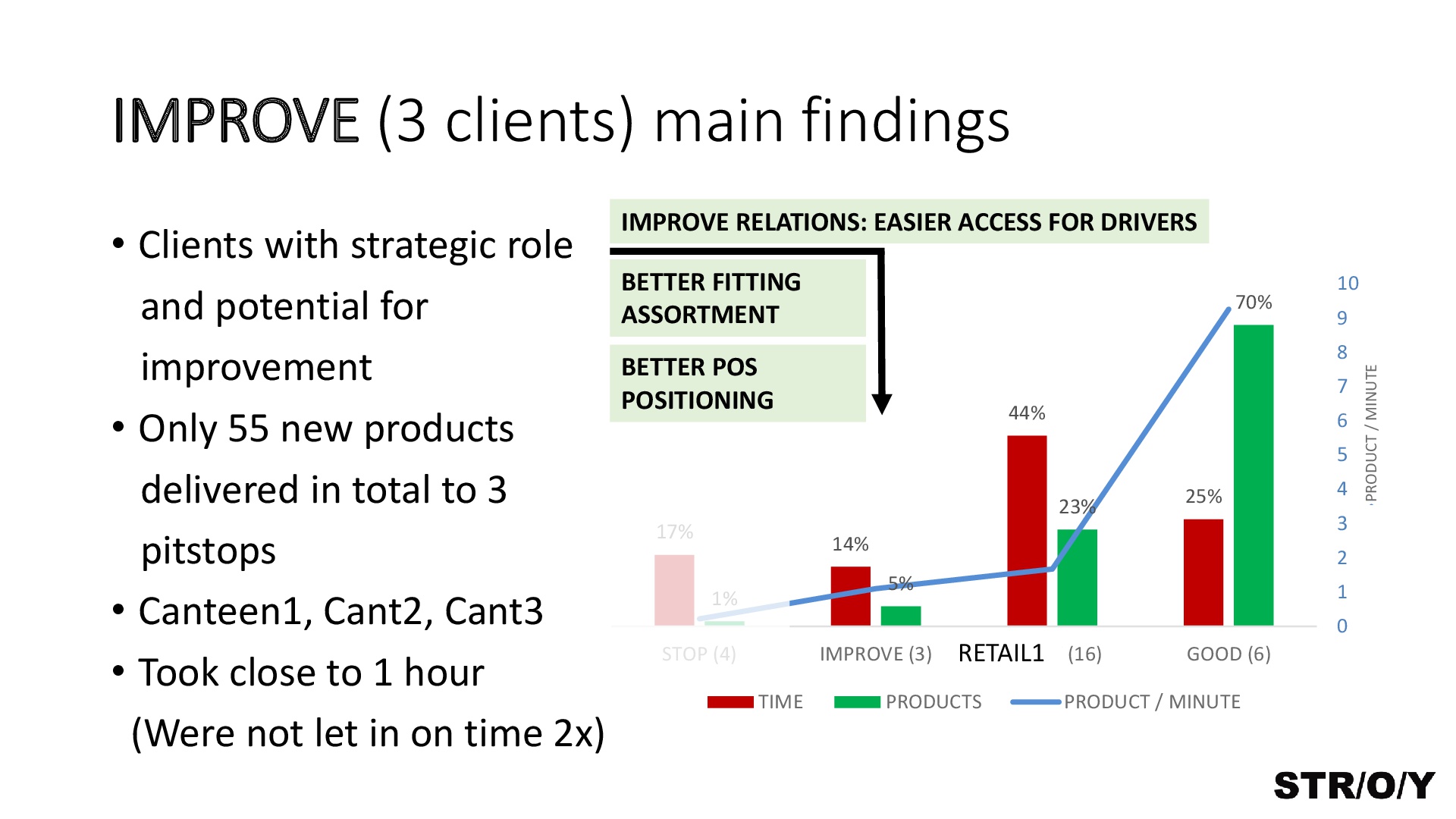

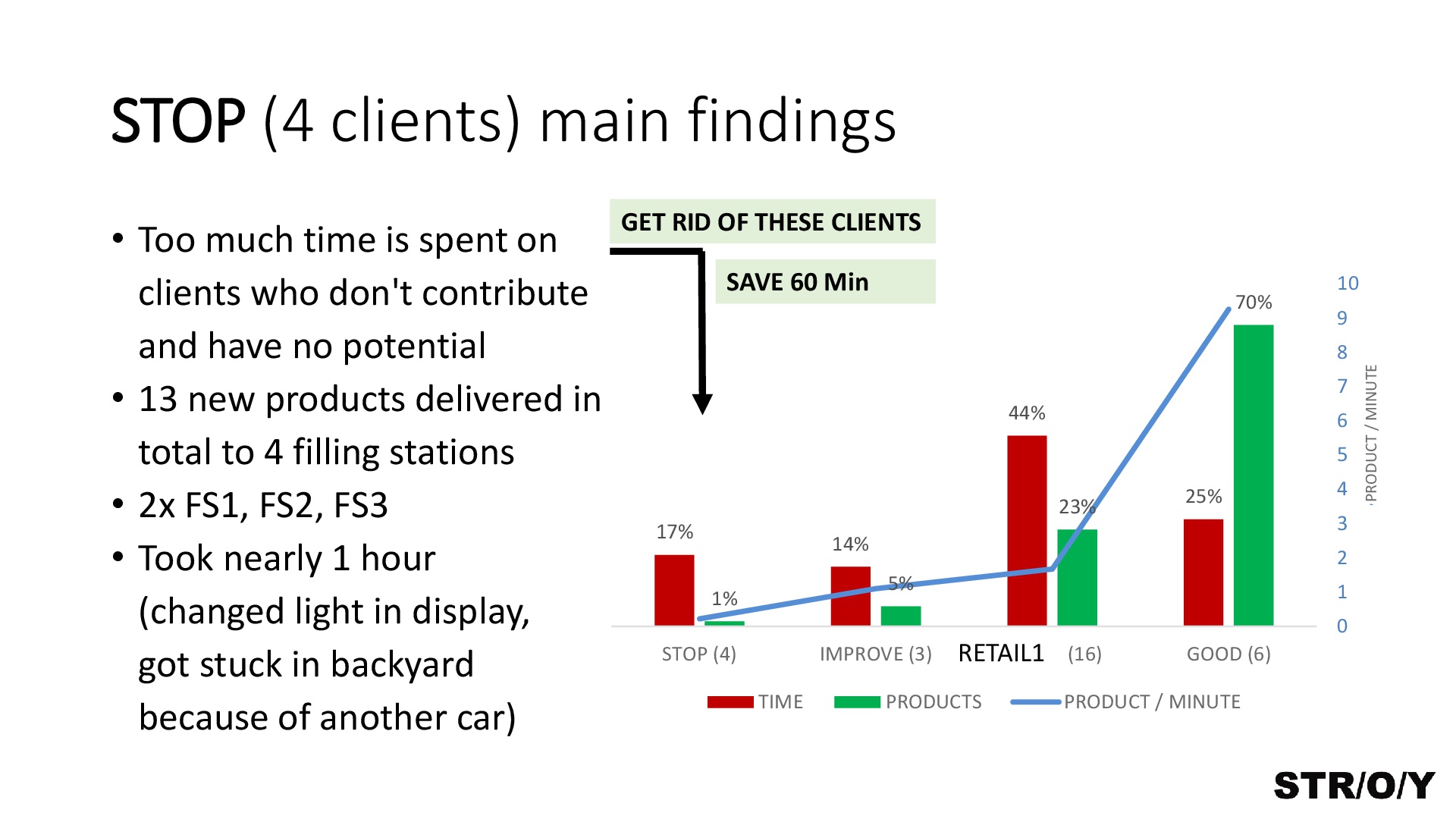

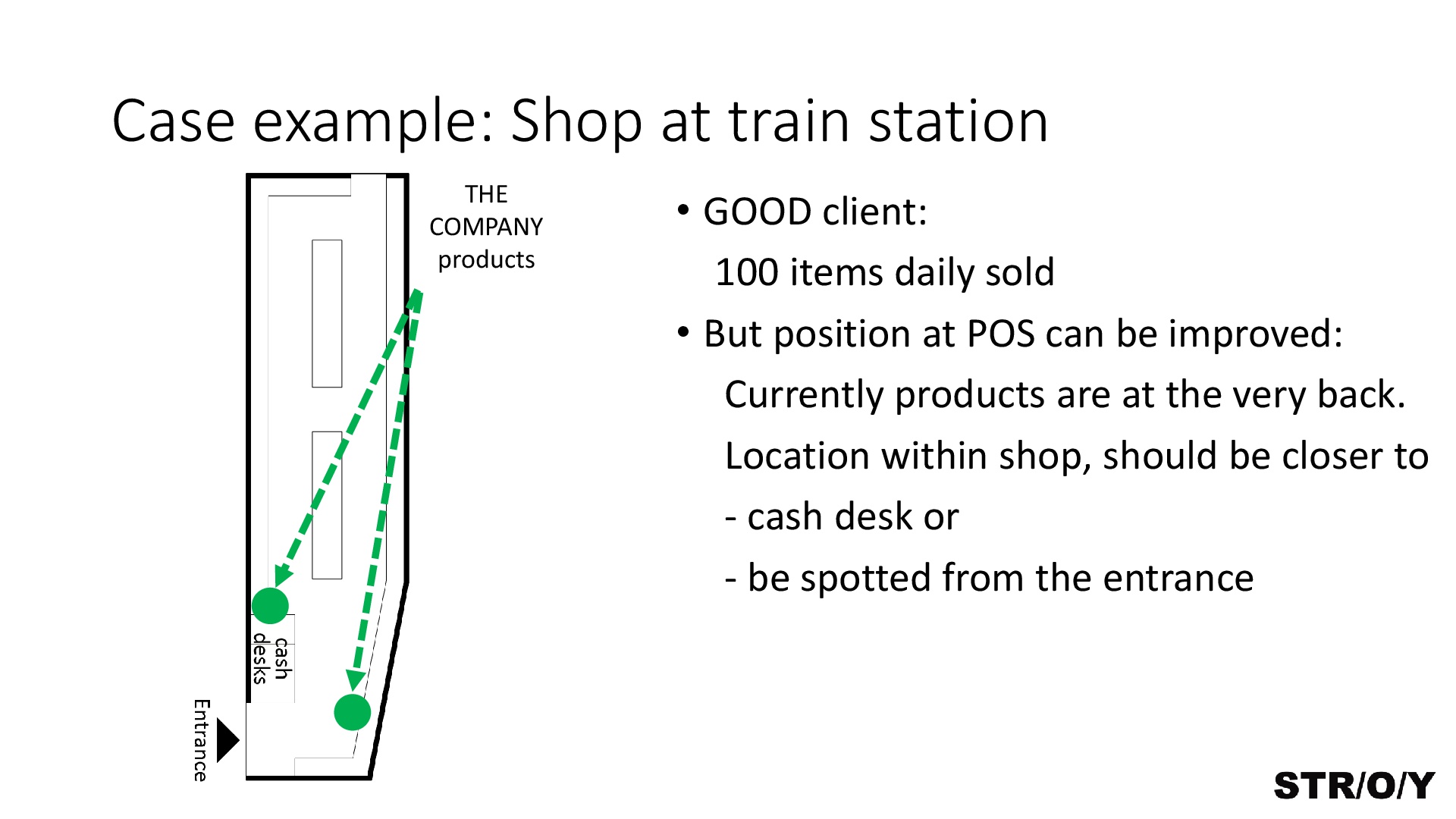

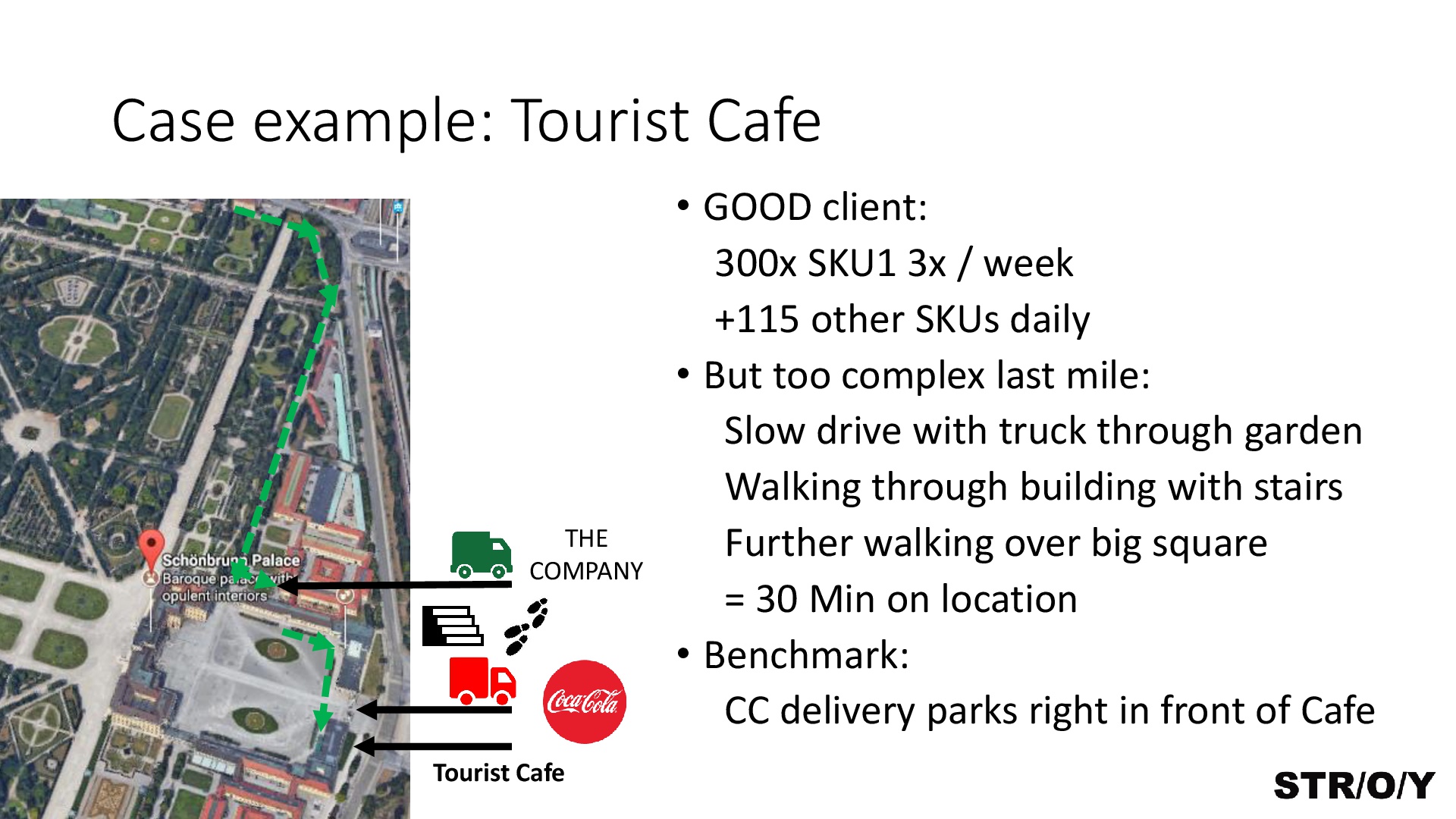

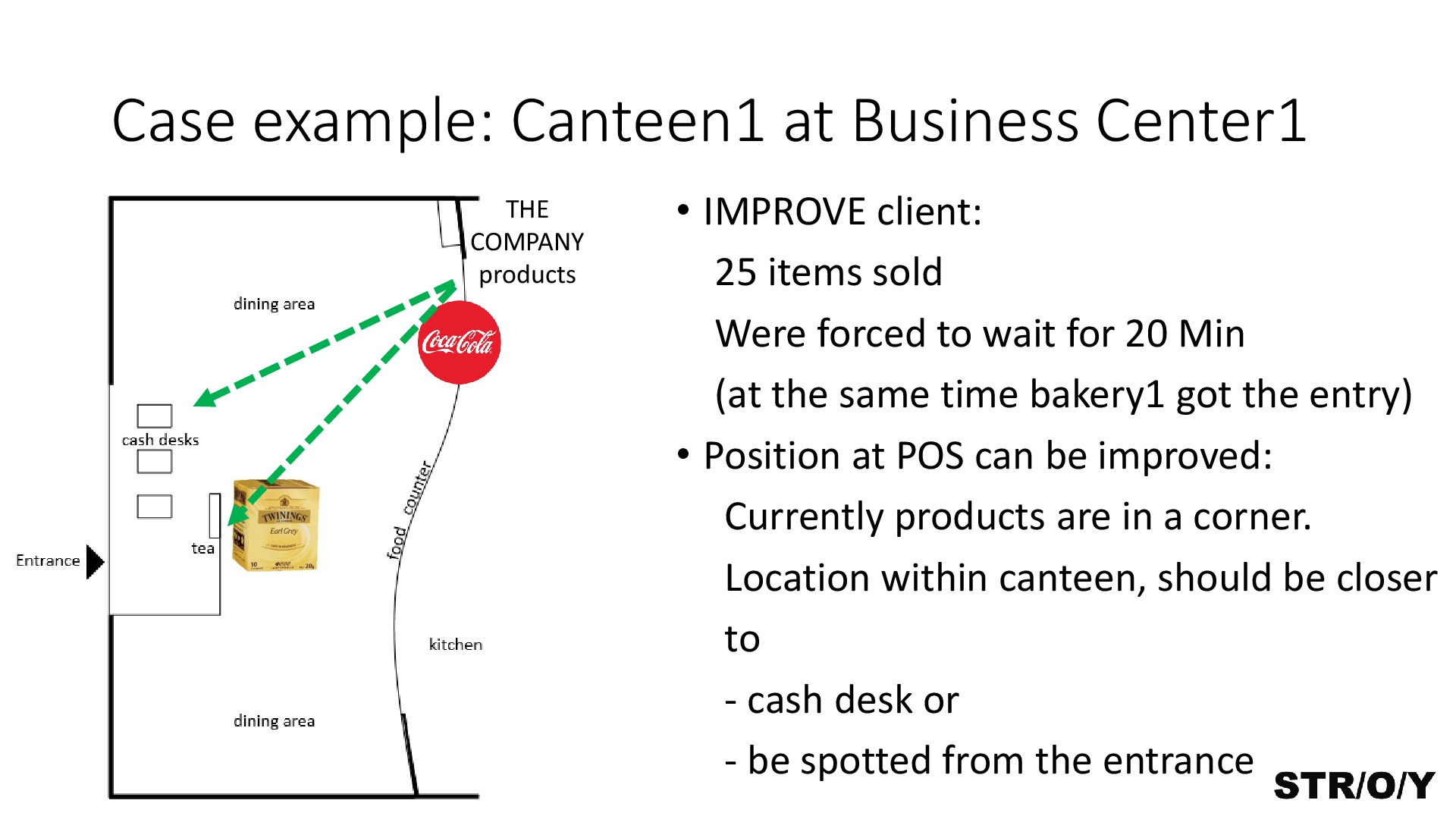

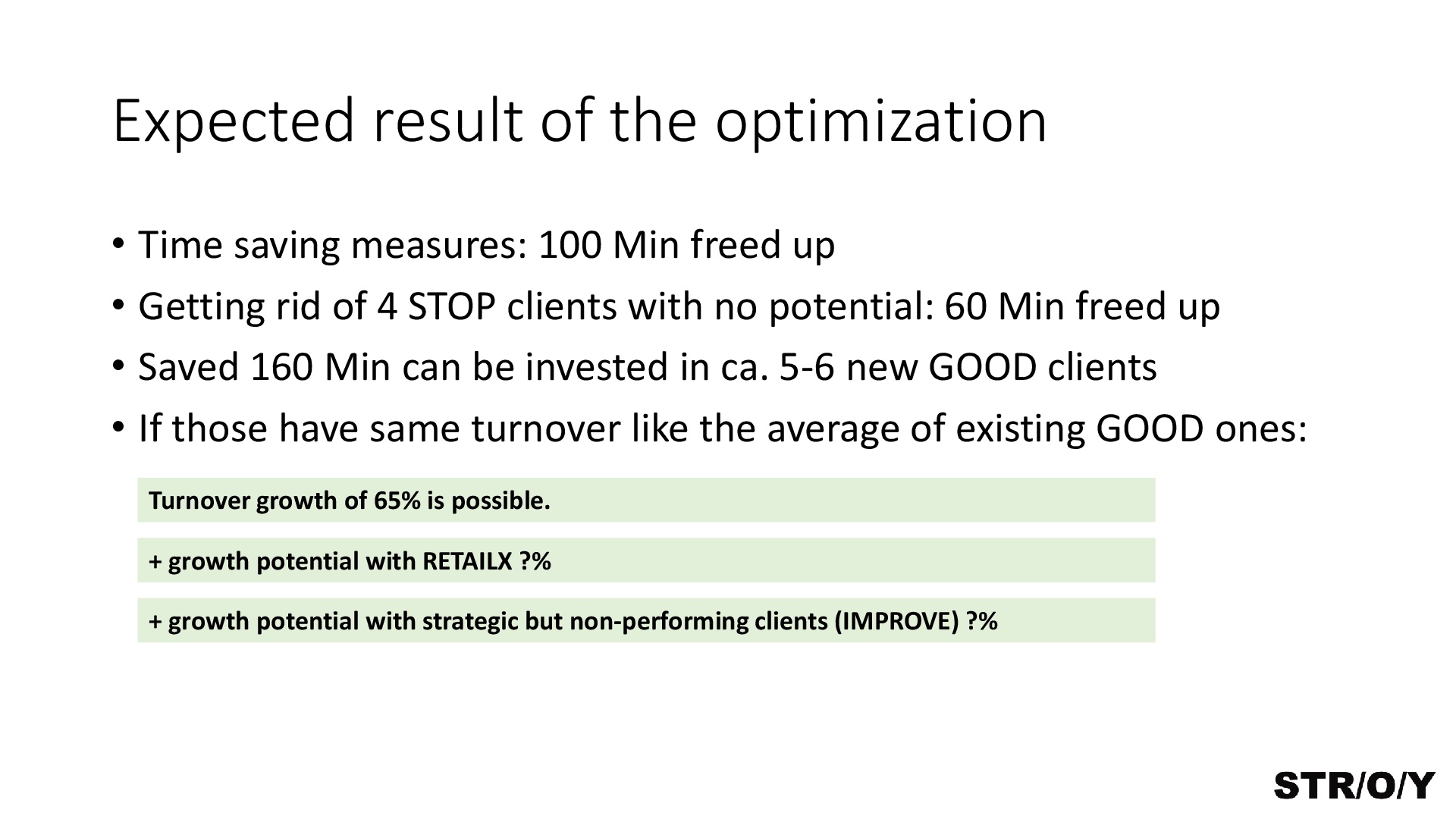

An in-depth analysis of the client’s operations was performed, including field research. Existing clients were evaluated and split into four groups based on their role for the company. Optimization measures for the current client portfolio were proposed. Selected case examples illustrate particular challenges and countermeasures in detail. A rough estimation for the expected result of the optimization was calculated. Tasks for Sales Management and examples for prospective future clients were deducted.

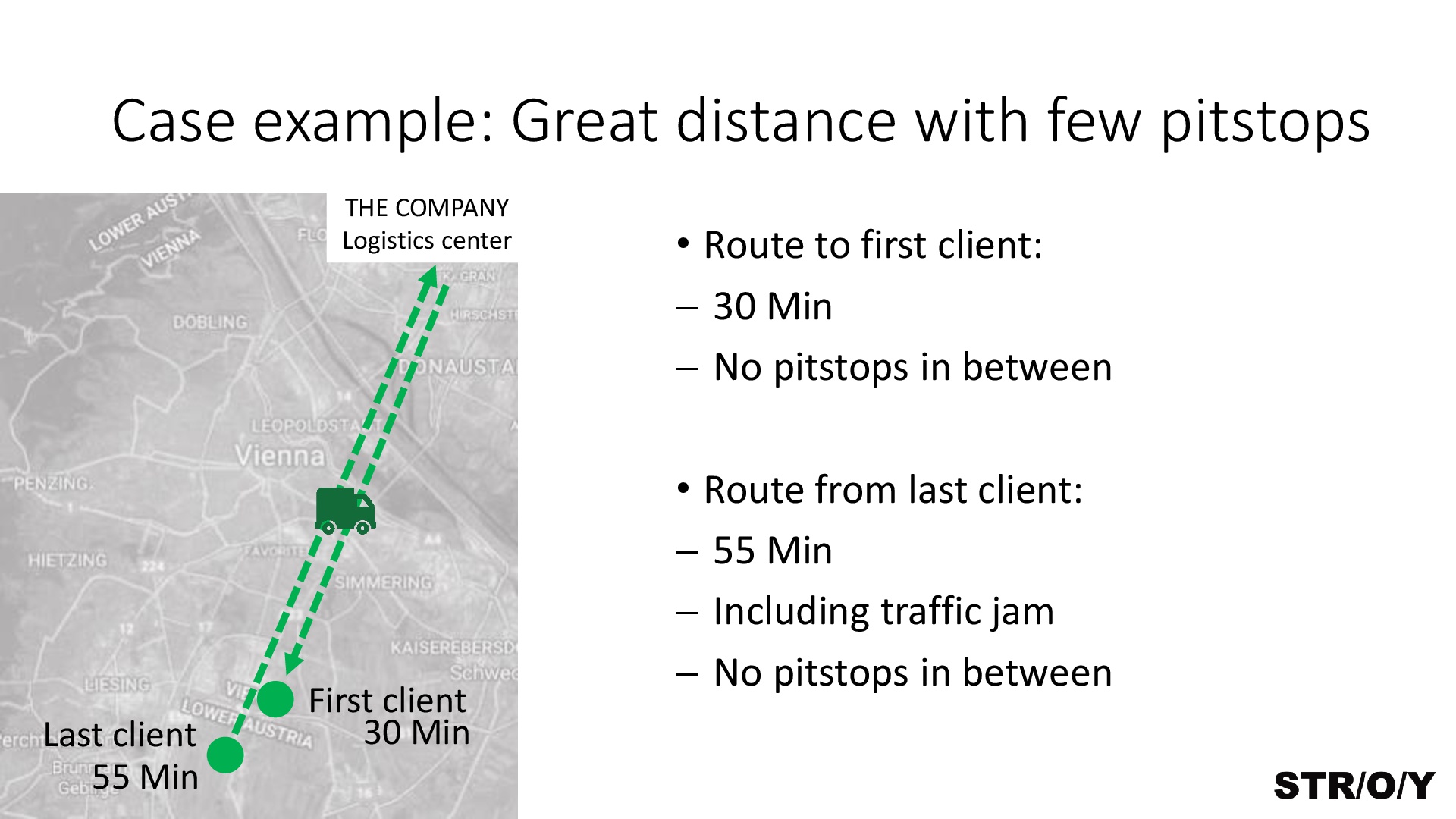

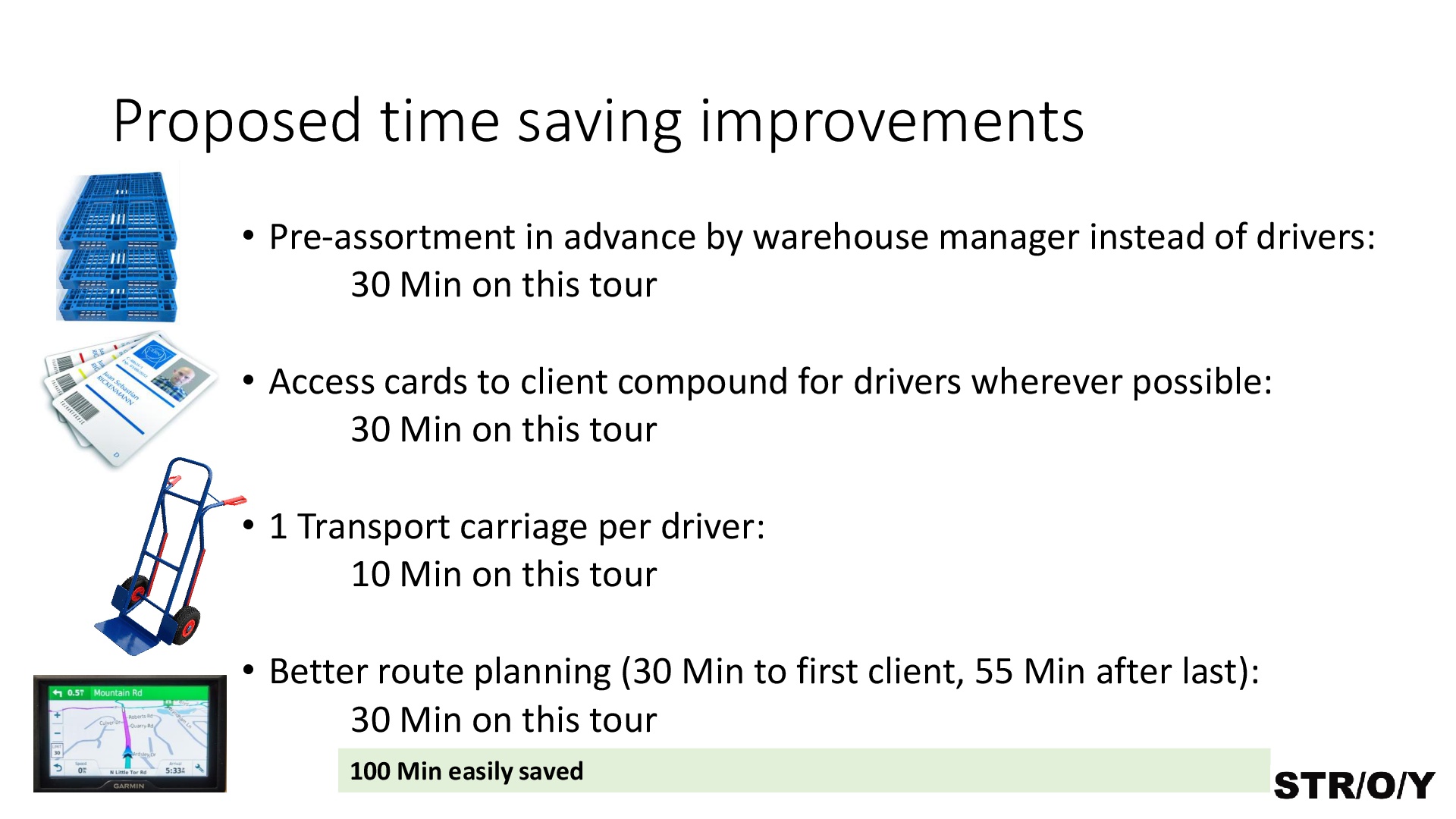

The Austrian country branch has been underperforming in comparison to its early growth phase years and to recent development of the company's benchmark markets as well. The problem's main source was detected in the current client base and the delivery operations. These two areas were targeted in the detailed optimization plan, which adressed strategic client base development measures and time saving improvements for logistical operations.

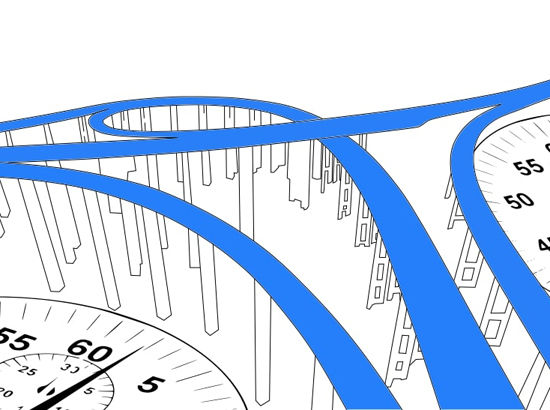

After a thorough analysis of the company’s client base, including a field study and full measurement of a representative delivery route - a detailed improvement plan was conducted. The analysis demonstrated a potential turnover growth of 65% and more than 3 hours of possible time saving per delivery route. The results were presented to the company owner and CEO.

| Sector: | Retail & FMCG |

| Type: | Operations optimization / analysis |

| Level: | National |

| Partner: | Leading austrian bakery retail chain |

| Task: | Finding causes for high employee turnover rate and proposing measures to lower it down |

A large bakery retail chain in Vienna struggled with the employee turnover. The company has made efforts keeping its image as an employer high through marketing measures & the establishment of a dedicated “career center” for fast and unbureaucratic job entry. Concern emerged that young part-time employees needed a substantial amount of time to get accustomed with the large product range and the instore work processes. Students often left the company out of frustration and the bakery had to invest efforts of its more senior store employees for frequent mentoring of their young and often only short-term colleagues.

The lack of product knowledge and slow execution on the side of the young staff as well as the inefficient use of the experienced store staff’s resources posed a great threat to the client’s competitive edge.

A detailed analysis of the client’s retail operation was performed. Store staff and managers were interviewed about the current on-boarding procedure of an employee’s first month. All processes were documented and efficiency failings detected.

3 sources for the high turnover rate of new employees were detected and processes were overhauled.

A concept was presented for a product learning app, which would replace the existing practice of asking the new employee to memorize products and their details just by looking at them on the website and having to pass a test only 1.5 months after company entry. Positive results and on-going improvement on the app would be incentivised with coupons.

In the course of the interviews it became clear that even long term employees (up to 10 years of tenure at the company) were not entirely accustomed with the product names and features.

The concept proposed to aim at 3 groups with the app. First, offering the app as part of the job application process, to test candidate’s commitment and to prepare them for the rich product assortment. Second, new employees would be asked to reach a certain level of measurable product knowledge at a much earlier stage than before, this way giving them a greater feeling of safety towards the clients’ questions and more motivation right from the start. The third group are the established employees who could close old knowledge gaps and would be informed via app in the most immediate way about changes in the assortment or a product’s features.

The systemic lack of new employee’s pace could also be tracked down partly to poor labeling and order in the store’s cold chambers.

Another source for the high employee turnover rate was the lack of protocol. This resulted in some store managers granting new employees breaks every two hours, while other managers kept the employees working full uninterrupted 6 hour shifts. During which the employees reported low concentration levels.

New app and gratification system were put into development.

Labeling and order in the cold warehouse were made subject to evaluation.

| Sector: | Chemical industry |

| Type: | Business development programme |

| Level: | National |

| Partner: | Leading Western European conglomerate with focus on specific plant nutrition |

| Task: | Drafting a business development programme with emphasis on most urgent measures to ensure turnover growth |

A leading Western European conglomerate experienced difficulties in the growth of its Austrian plant and animal nutrition group. The company set itself the ambitious goal of a 5% annual turnover growth during 5 consecutive years. The group holds a niche position in its market, faced a decline of agricultural industry and is relying on sales solely through distributors. It has a price disadvantage, but can benefit from its tight industrial production network.

Taking the circumstances into account focus was put on how to exploit the resources that were already in place. Therefore the first five necessary steps to achieve the company targets were: getting a complete picture of the company’s in- and outside stakeholders and to create a positioning of the company and its products that empowers sales growth. This lays the ground for the main operational steps: it was necessary to produce a jump in demand within short time by activating existing loyal accounts and tapping into new easy opportunities. Armed with the results of these first successes negotiation of favourable conditions with current distributors and target new distributors would be the next step. The support from the distributor side would further drive the growth dynamic from farmers. The fifth step starts the cycle over again: keeping old and fresh clients satisfied and win over new ones, thus further solidifying the company's status with the distributors as a great selling product that they will be enthusiastic to push into the market.

To be in a niche market sets limitations - but gives the product also an edge. It sets the product apart from substitutes and makes it more immune against direct comparison with competition. Within a declining market like agriculture it is essential to have products that have differentiators: Although the trend sees the general market shrinking, the remaining participants (farmers), are growing by individual size and are getting more and more sophisticated. This is a favourable environment for a product that provides unmatched solutions to progressive farmers, who are capable and willing to invest in their own future growth.

A rough analysis of the company’s client base and upon it a roadmap improvement plan was created. The drafted measures demonstrated the possibility to fullfil the company's set goals. The results were presented to the regional management and will be adopted by the new local sales management.

| Sector: | Energy |

| Type: | Market study |

| Level: | International |

| Partner: | International investor platform |

| Task: | Evaluation of European electricity market, identification of potential, selection of investment targets |

An international investor platform wanted to provide its partner investors with an overview of the relevant success factors in the European electricity market. The study's goal was to bring light into this area of low-transparency. The task's complexity lied in the difficulty of finding the right long-term indicators for a reliable target country selection.

An in-depth desktop research was performed combining relevant and practical insights on market entry, market attractiveness and long-term outlook scenarios.

Most public studies in the area of the European electricity market are not written from an investor's point of view, but are either adressing stakeholders and decision-makers in politics, other representatives of the wider public, infrastructural areas and service providers. Therefore the relevant success factors in the European electricity market for investors had to be identified, found and interpreted in their combination with eachother. The defining factors of market entry ease for example, being market concentration, number of participants and market activity had to be evaluated. These information was then put opposite often conflicting data like price attractiveness, understood as absolute price, profitability and room for price policy. The combined evaluation price and market entry analysis gives a clearer view of the European electricity markets and results in a ranking of the current potential for investment by country. Mid and long-term development of tax related price factors, support level of renewable energy and regional market coupling had to be anticipated and plotted into the evaluation.

The analysis allows a detailed fact-based discussion on the most attractive European electricity markets. With certain limitations this study offers recommendations concerning relevant areas of investment. The materials also served as a starting point for further research into individual mothballed energy assets for the investor.

| Sector: | Retail & FMCG |

| Type: | Consultation & market study |

| Level: | International |

| Partner: | Leading non-food FMCG manufacturer |

| Task: | Evaluation of European hard-discount retail, identification of potential and dangers for FMCG brands |

An international non-food FMCG branded goods producer wanted a solid basis for his negotiation and decision making process concerning the market entry into a hard-discount channel. To provide the company with consultation and a structured overview of the relevant factors for large brands in the discount market an in-depth study into the topic was conducted. The goal of this study was to lay open all relevant mechanics between disocunt, branded goods and consumers. The task's main challenge lied in the secretive nature of hard-discount retailers and the relatively short and very diverse empirical experience of branded goods in hard-discount.

An in-depth desktop research was performed, followed by a field research covering all aspects of brands being present in dicount channels, compared with their situation in classic non-discount retail.

The large study sheds light on the relationship between discount and brand buying consumers. It covers brand communication strategies of discount channels. Crucial questions relevant to branded goods manufacturers are answered and illustrated with real-life cases. The real role of price leadership and the defence of core profile categories for discounters are explained. Their implications and dangers for branded goods (like price wars) are presented. Backgrounds for entry decision into hard discount are given and notable exceptions for not listing top sellers are also deducted case by case. Defence mechanisms of traditional retail towards branded goods manufacturers entering discount are showcased, e.g. retaliation measures via outlisting of less popular products like slowly-developing innovations. The potential for merchandize within hard-discount and a discounter’s communication logic is laid open.

The branded goods manufacturer received a detailed consultation on a crucial strategic decision. The company gained a thorough understanding of the discount retailer’s motives for turning towards brands. The strategy to win back private label buyers, over the discount loop way and turn them again into brand buyers was elaborated on. The results were presented to leadership in Austria and Germany and the company was able to make the decision with a very clear view of all factors implied.